eStore®

eStore®

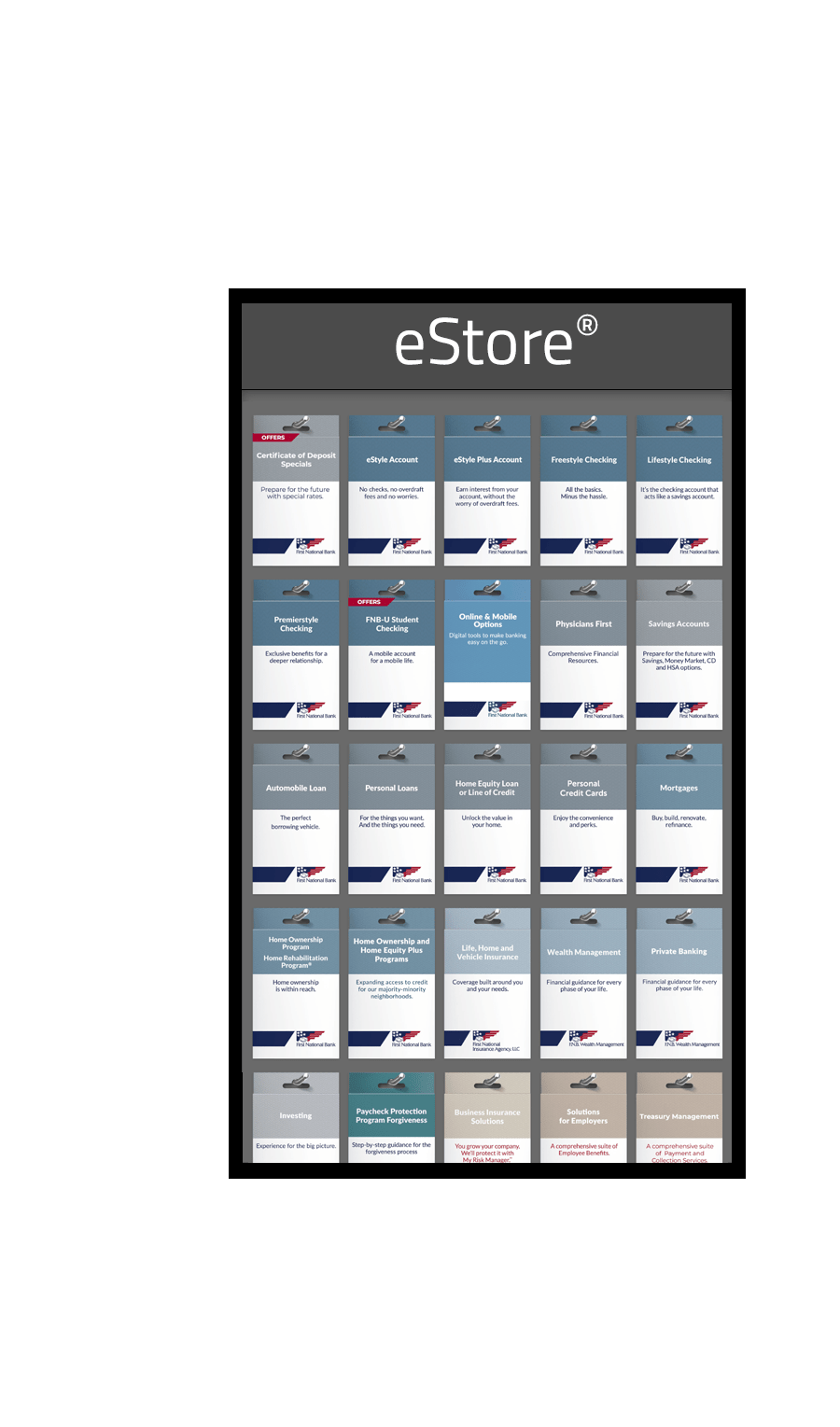

Shop and buy products and financial services online. Explore our products and financial education to find the solutions you need. Check out to easily apply online or schedule an appointment for expert, in-person guidance.

See it Now

Business

Business