Login

- Consumer Lending

- Wealth Management

- Brokerage

- Insurance

- eStore® Common App

Managing Your Business Checking Account to Avoid Overdrafts

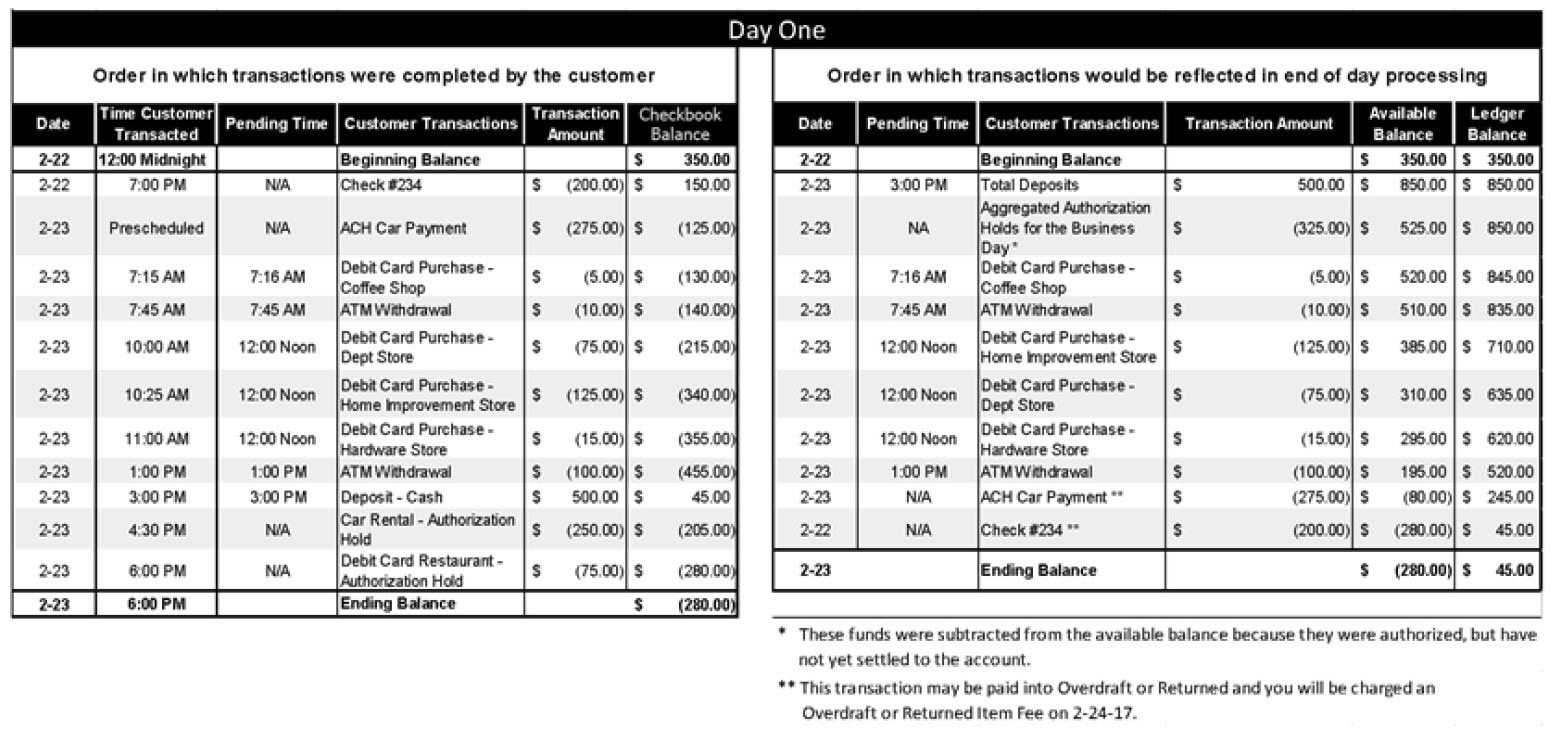

It is important to also understand how debit card transactions are authorized and approved when you conduct transactions without entering a PIN, the merchant checks to determine whether or not you have a sufficient available balance to complete the transaction. This is called a a pre-authorization. Pre-authorization reduces the available balance in your account.

The second step in the process is the actual amount of the transaction that is posted to your account, which may occur the same day or a few days later. This amount is called the Settlement. This amount may or may not be the same amount as the pre-authorization depending on the type of merchant. For example, in cases like hotels, gas stations and car rentals, the amount of the pre-authorization oftentimes exceeds the final settlement of the transaction amount.

Your Account’s Available Balance is $350. You start your day off by purchasing paint ($8) at 7:15 AM and then visit the ATM to withdraw cash ($10) at 7:45 AM. Throughout the morning you run errands and make purchases using your debit card at a garden supply store ($75), a home improvement store ($125) and a hardware store ($15). You also make a second stop at the ATM at 1:00 PM and withdraw additional cash ($100). You receive payment from a customer in cash ($750) and you deposit this amount at an FNB branch at 3:00 PM. Your last errand is to rent a car and your debit card is pre-authorized for this rental ($250). Later, you go out to dinner and your server pre-authorizes your debit card ($75).

At the end of the day, your Available Balance is negative $33. You will be assessed three Overdraft fees for the hardware store ($15) and paint store ($8) purchases, and the ATM withdrawal ($10).

Your Business Checking Account is the engine that drives your businesses’ day-to-day finances. Take care of it, and you will avoid Overdraft and other unnecessary fees while keeping things running smoothly. If you have any questions, please refer to your Deposit Account Agreement, visit your nearest FNB branch or call our Customer Service Center at 1-800-555-5455.

Download this document.

Download PDF