Login

- Business Banking

- Business Services

- Business Insurance

- Wealth & Investing

- Pittsburgh, PA

FNB Unveils Mobile eStore

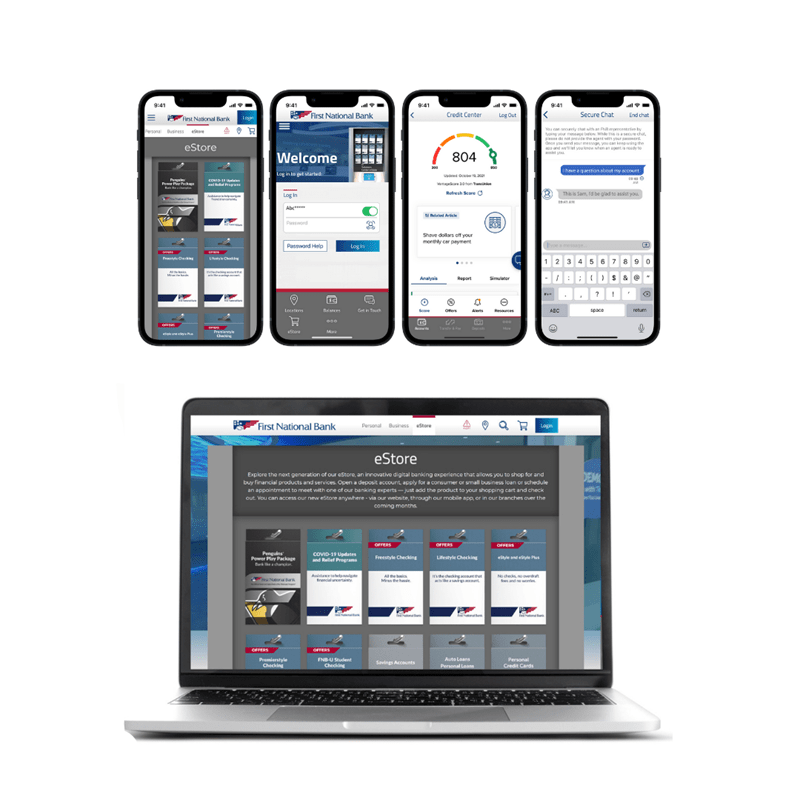

Company Integrates eStore Digital Bank into Mobile App as Part of Significant Upgrade

F.N.B. Corporation (NYSE: FNB) announced it has integrated its eStore shopping tool into the FNB Direct mobile app as part of a series of innovative enhancements that build on customers’ ability to bank digitally. Along with a significant upgrade to its mobile banking experience, including multiple new features, the Company has expanded its suite of online loan applications.

“Adding the eStore to our mobile app creates a fully digital bank, where customers can conduct routine transactions, purchase products and services, and schedule time with our bankers virtually,” said Vincent J. Delie, Jr., Chairman, President and Chief Executive Officer of F.N.B. Corporation and First National Bank. “We combine the latest industry technology with personalized service so that customers can access the tools, information and consultation they need, whether they are in an FNB branch or are using an online or mobile device.”

eStore Enhances FNB’s Solutions Center Concept

FNB has enhanced its proprietary Solutions Centers with the transition to the eStore. Now available in the FNB Direct mobile app and on fnb-online.com, the eStore also will be made available at interactive kiosks in First National Bank branches in 2022. The eStore enables customers to use digital technology to complete a wide range of banking activities, including:

To view a video about the eStore, visit the Clicks-to-Bricks page of FNB’s website.

Upgraded Mobile Features

In addition to integrating the eStore, FNB has redesigned FNB Direct to be even more user-friendly. The upgraded app incorporates a new, modern look, streamlined navigation and direct access to the features customers are most likely to use, such as account balances, Zelle® payments, shopping and account opening tools, and FNB contact information.

Highlights include:

These additions build on FNB’s feature-rich mobile banking experience, which includes mobile deposit capabilities, and are part of an extensive list of updates that enable customers to do more of their banking from their mobile device. Other new capabilities include adding new online bill payees, scheduling recurring and future-dated transfers, importing contacts for Zelle® payments and accessing eStatement and payment history. Additional enhancements are on FNB’s roadmap for early 2022.

Additional Online Loan Applications

FNB continues to expand the types of loans and other services for which consumers can apply online, with applications now available for FNB Credit Cards, Mortgage products, Home Equity Lines of Credit, Home Equity Installment Loans and Asset-Based Loans for small businesses. The Company will continue to integrate additional products and services into its digital platform over time.

FNB is advancing toward its goal of delivering a simplified, universal application to make it even easier for consumers to access financial solutions, including credit. Since the digital Mortgage experience was launched in May of 2021, 61 percent of FNB’s mortgage applications have been submitted digitally, with nearly 50 percent of those submitted outside of normal business hours, demonstrating a significant need for these online services.

In addition to contributing to a premium customer experience, FNB’s digital strategy is a driver of efficiency and overall performance. For more information on FNB’s online and mobile banking channels visit the Company’s website. First National Bank is an Equal Housing Lender, Member FDIC.

About F.N.B. Corporation

F.N.B. Corporation (NYSE: FNB), headquartered in Pittsburgh, Pennsylvania, is a diversified financial services company operating in seven states and the District of Columbia. FNB’s market coverage spans several major metropolitan areas including: Pittsburgh, Pennsylvania; Baltimore, Maryland; Cleveland, Ohio; Washington, D.C.; and Charlotte, Raleigh, Durham and the Piedmont Triad (Winston-Salem, Greensboro and High Point) in North Carolina. The Company has total assets of more than $39 billion and more than 330 banking offices throughout Pennsylvania, Ohio, Maryland, West Virginia, North Carolina, South Carolina, Washington, D.C. and Virginia.

FNB provides a full range of commercial banking, consumer banking and wealth management solutions through its subsidiary network which is led by its largest affiliate, First National Bank of Pennsylvania, founded in 1864. Commercial banking solutions include corporate banking, small business banking, investment real estate financing, government banking, business credit, capital markets and lease financing. The consumer banking segment provides a full line of consumer banking products and services, including deposit products, mortgage lending, consumer lending and a complete suite of mobile and online banking services. FNB's wealth management services include asset management, private banking and insurance.

The common stock of F.N.B. Corporation trades on the New York Stock Exchange under the symbol "FNB" and is included in Standard & Poor's MidCap 400 Index with the Global Industry Classification Standard (GICS) Regional Banks Sub-Industry Index. Customers, shareholders and investors can learn more about this regional financial institution by visiting the F.N.B. Corporation website at www.fnbcorporation.com.

###