Zelle®

Zelle® is a fast and easy way to send and receive money with friends, family and others you trust, even if they don't bank with First National Bank.1

Zelle® is a fast and easy way to send and receive money with friends, family and others you trust, even if they don't bank with First National Bank.1

With Zelle® and First National Bank, you can use Online Banking or FNB's mobile banking app, FNB Direct, to quickly send and receive money.2,3

FNB and Zelle®

With Zelle®, you can send money to almost anyone you know, almost anywhere in the U.S., even if they don't bank with FNB.1 Forget about sending cash, writing checks or searching for an ATM. Zelle® is available within FNB’s Online and Mobile Banking services.

Money goes straight into your account. If you are both enrolled, the money is typically sent in minutes.1

All you need is the recipient's email address or U.S. mobile number.

No personal information or account details are shared, keeping your data secure.

To begin using Zelle®, you need to have access to Online or Mobile Banking. See below to learn how to use these services. Note that the User ID and Password you select will be used for both Online and Mobile Banking.

Log into Online or Mobile Banking

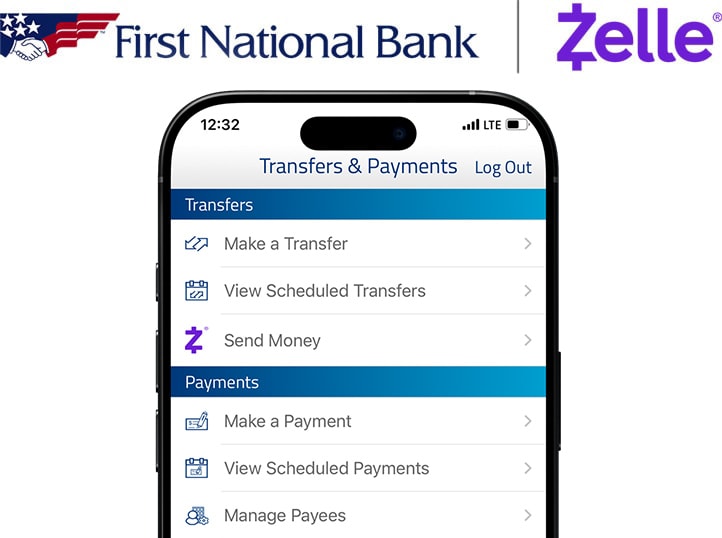

Once enrolled, log into Online or Mobile Banking and visit the Zelle® page to set up your account for use with Zelle®. Zelle® can be found within the Transfers tab of Online Banking and within the Transfer & Pay tab of Mobile Banking.

Select or Enter Contact Method

To send or receive money using Zelle®, you need to have an email address or U.S. mobile number on file. People will use this email address or U.S. mobile number to send you money or request money from you.

Verify Your Contact Method

To ensure you own and have access to the email address or U.S. mobile number, we will send a short code to that email or U.S. mobile number which you will need to enter into the system to complete enrollment.

Select Your Funding Account

Select the FNB account you would like to use with Zelle®. This is the account from which Zelle® transfers will be made and into which Zelle® transfers to you will be deposited automatically.

Set Up Your Recipients

To begin using Zelle®, enter the names and email addresses/U.S. mobile numbers for people you know and trust.2 You can add people right from your smartphone's address book or contacts list or enter a person's contact information manually. You don't need to add anyone in order to receive money using Zelle®.

Send money directly to the recipient using just their email address or U.S. phone number, typically in minutes.

Send a request for money. The person who receives the request will be able to accept or decline. If they accept, you will typically receive the money in minutes.1

If you need to split the cost of a bill or share a cost with multiple people, you can use the split feature to calculate how much everyone owes and send a request for money.

Zelle® is a fast and easy way to send, request and receive money.

Only send money to friends, family and others you trust

Beware of payment scams

Treat Zelle® like cash. Once a transaction is complete, it cannot be canceled.

Learn more about how you can

Pay it Safe with Zelle®

1 - To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users

typically occur in minutes.

2 - It is important to know and trust those you send money to. Once you authorize a payment to be sent, you can't cancel it if the recipient is already

enrolled in Zelle®. The money moves quickly - directly into the recipient's bank account, typically within minutes.

3 - In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled in Zelle®. Payment requests to persons not already enrolled with Zelle® must be sent to an email address.

4 - Apple is a registered trademark of Apple, Inc. Google Play and the Google Play logo are trademarks of Google LLC.

5 - Must have a bank account in the U.S. to use Zelle®.

6 - Mobile carrier fees may apply.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.