Monthly Economic and Investment Outlook

August 2025 Economic and Investment Outlook

August 2025 Economic and Investment Outlook

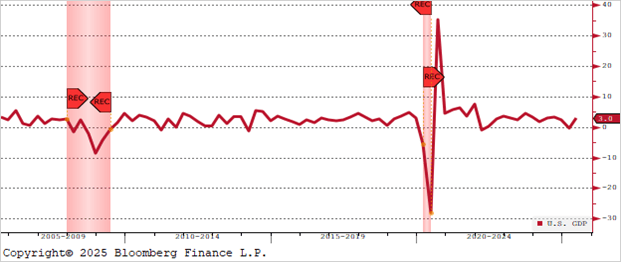

U.S. GDP Quarter-Over-Quarter

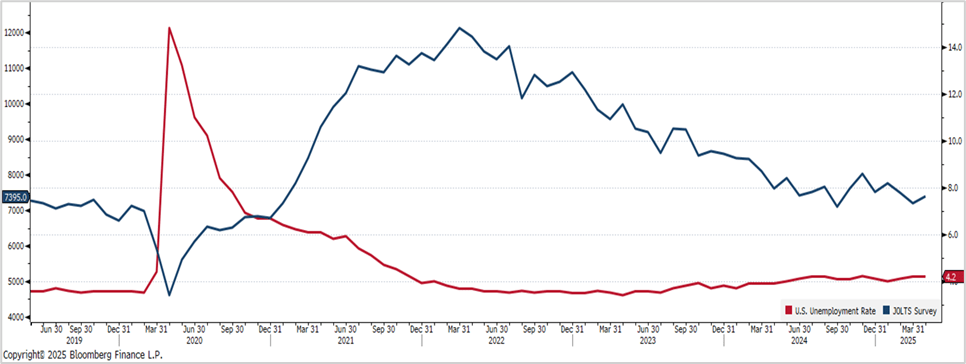

U.S. Unemployment vs. Job Opening

U.S. Imports from China

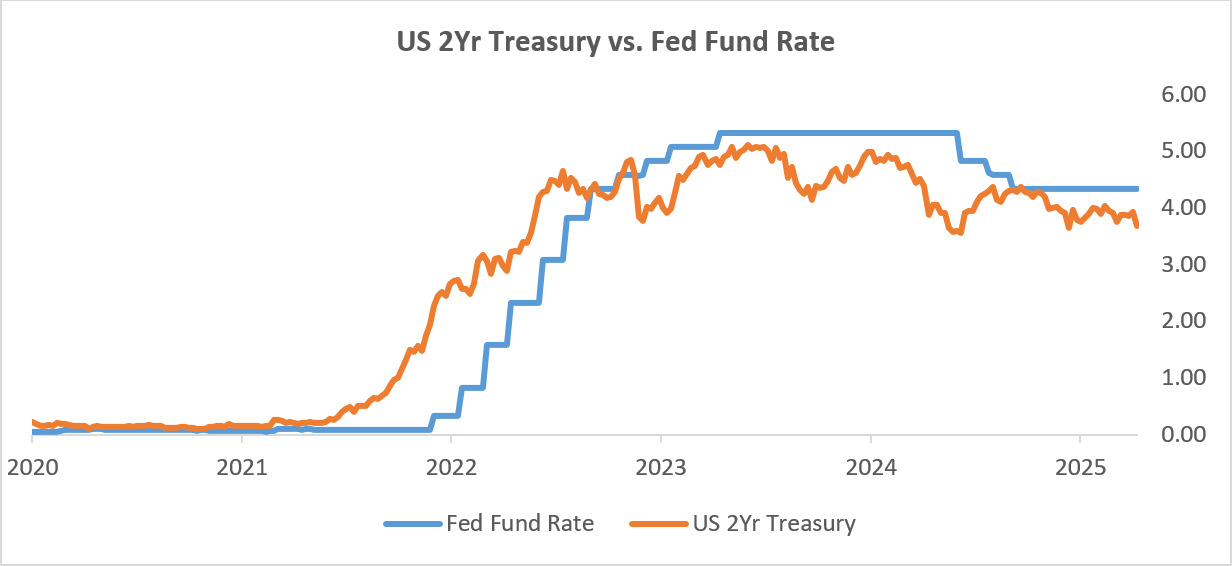

Global Short-Term Rates

Sources: Federal Reserve, Bloomberg

Source: Bloomberg

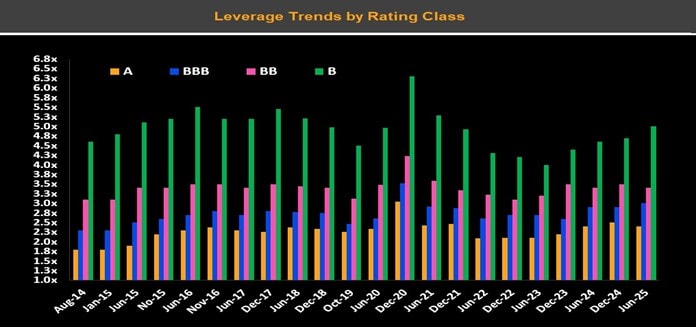

Sources: Strategas, Factset Data as of 7/31/2025

Sources: ASR Ltd., LSEG Datastream

Products and services offered through F.N.B. Wealth Management are not FDIC insured; and are not insured by any Federal Government Agency, are not deposits or obligations of or guaranteed by First National Bank of Pennsylvania or its affiliates and may go down in value.

This report reflects the current opinions of the authors. It contains forward-looking statements which are based on assumptions and are speculative in nature, and actual outcomes may materially differ from our expectations. Opinions, forward-looking statements, and assumptions are subject to change without notice, and various factors including changes in market conditions, applicable laws, or other events may render the content no longer reflective of our positions. Information in this report is based upon sources believed, but not guaranteed, to be accurate and reliable.

Investing involves risk and past performance is no guarantee of future results, and there can be no assurance that any investment, strategy, allocation, or product referenced in this report will be profitable, equal any historical performance, or be suitable for your portfolio or individual situation. The S&P 500 Index, generally considered representative of the large-cap U.S. equity market, is an unmanaged, value-weighted index of 500 common stocks. Indices are not available for direct investment, and index performance does not reflect the expenses or management fees associated with investing in securities. Personal Consumption Expenditures (PCE) is a measure of the total amount of money spent by individuals and households in the US on goods and services. The Federal Reserve Open Markets Committee (FOMC) is a committee within the U.S. Federal Reserve System (the “Fed”) overseeing open market operations and directing monetary policy. The Federal Funds Rate is the interest rate at which banks lend reserves to each other overnight, for which the FOMC sets a target range.

Allocations in this report reflect FNBIA’s current positioning for the referenced strategies and are provided for informational purposes only. The report does not constitute an offer, solicitation, or recommendation to buy or sell any security or take any particular action, nor does it include personalized investment advice or account for the financial situation or specific needs of any individual. You are encouraged consult with your investment professional regarding its applicability to your individual situation.

F.N.B. Wealth Management (“FNBWM”) refers to the investment management, custody and trust services offered by First National Trust Company (“FNTC”) and the investment management services offered by FNTC’s subsidiary registered investment adviser, F.N.B. Investment Advisors, Inc. (“FNBIA”). FNTC is a subsidiary of First National Bank of Pennsylvania (FNBPA) and F.N.B. Corporation (FNB). Accounts are not insured by the FDIC or any other government agency and are not deposits or obligations of or guaranteed by FNBPA or any FNB affiliate, and may go down in value.